Florida’s tepid financial interest reporting requirements reveal very little about the financial income or obligations of the five city commissioners holding office. They aren’t required to report home ownership or mortgage debt and they don’t have to report their yearly income. Commissioners only have to report the source of their income and any major liabilities.

More stringent reporting requirements kick in next July when the state will require officeholders to report their net worth, assets over $1,000, liabilities over $1,000, and all sources and amounts of income over $1,000.

Here are the state-required disclosures of each city commissioner filed last July:

James Antun – his primary source of income is from 8 Flags Chiropractic Inc. in Fernandina Beach. He lists a savings account associated with the business. He did not report his $12,000 annual city commissioner salary.

He reported no liabilities.

According to the Nassau County Property Appraiser’s public records, Antun pays taxes on a house at 704 S. 12th Street, Fernandina Beach. The listed market value is $358,408.

Darron Ayscue – lists his primary source of income as Nassau County Fire and Rescue as a firefighter. He did not report his $12,000 annual city commissioner salary.

He listed no secondary income. No interests in other businesses. No liabilities and no ownership of other properties.

According to the Nassau County Property Appraiser’s public records, Ayscue pays taxes on a house at 814 N. 14th St., Fernandina Beach. The listed market value is $526,871.

Bradley Bean – lists the RYAM mill as his primary source of income. He also reported income from High Energy Auctions and his $12,000 annual city commissioner salary. He reported a 401(k) at RYAM as intangible personal property. He listed his property at 1512 Inverness Road, Fernandina Beach. According to the Nassau County Property Appraiser’s public records, the listed market value is $338,735.

Bean reported no major liabilities and no specified interests in other businesses.

Chip Ross – lists his primary source of income as Social Security, as an emergency room doctor (he has since retired), his $12,000 annual city commissioner salary and his company PCare as an expert medical witness for various law firms.

Ross lists his house at 210 N. 3rd Street, Fernandina Beach. According to the Nassau County Property Appraiser’s public records, the listed market value is $617,732.

He listed stocks in a 401(k) with Vanguard, stocks with T. Rowe Price and cash assets at Bank of America.

Ross listed no major liabilities.

David Sturges – listed Sturges & Sturges Construction Inc., as his primary source of income. A secondary source listed is Park Bench Investments, which is a property investment company. He did not report his $12,000 annual city commissioner salary.

He reported owning stock in PNC Bank and ML Bank.

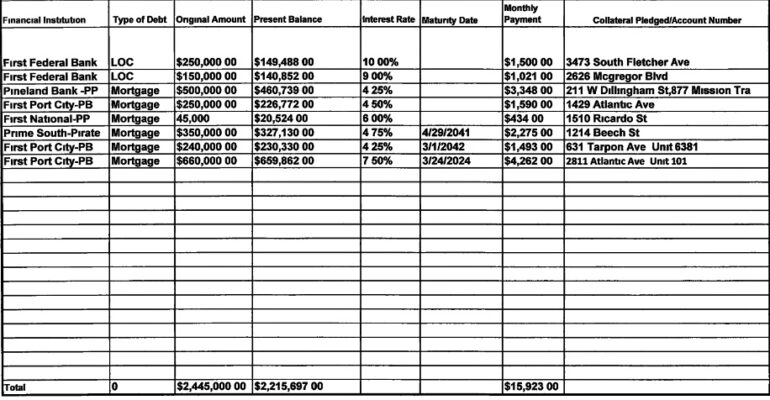

Sturges reported a major liability of $2,215,697 with a monthly payment of $15,923 to five different banks. The liability list is posted below.

Sturges has numerous properties in Nassau County including a home at 319 Benjamin, Fernandina Beach. According to the Nassau County Property Appraiser’s public records, the listed market value is $485,650.

He owns an office building under the company Pirates Booty at 1214 Beech St., Fernandina Beach with a mortgage balance of $327,130. According to the Nassau County Property Appraiser’s public records, the listed market value is $246,462.

Sturges reported ownership of properties under Park Bench Investments including:

631 Tarpon Ave. unit 6381 market value $310,000

631 Tarpon Ave. unit 6391 market value $310,000

2811 Atlantic Ave. unit 101 market value $685,000

2626 Gregor McGregor Blvd market value $736,161

3473 S. Fletcher market value $1,274,713

1429 Atlantic Ave. market value $522,245

3480 First Ave, market value $1,274,713

3482 First Ave.

3484 First Ave.

Lot 1 Faith Ave., Yulee market value $105,199

Lot 2 Williams Ave., Yulee market value $118,806

Other properties listed include:

397 NW. Hamilton St., Lake City

447 NW. Hamilton St., Lake City

427 NW. Hamilton St., Lake City

620 NW. Florida Ave., Lake City

771 NW. Georgia Ave., Lake City

1510 Ricardo St., Valdosta GA

211 W. Dillingham St., St Marys, GA

877 Mlssion Trace Dr., St Marys, GA

277 W. Fulford Street, Kingsland, GA

The Observer and Mike Lednovich at it again. No matter the damage they cause or people and families they put in harms way, they will push their agenda. There’s a reason laws exist but even respect for first responders and their families is not safe. I hope all police and firefighters see what this organization will do to hurt you if you get in their way.

“d. The home addresses, telephone numbers, dates of birth, and photographs of current or former firefighters certified in compliance with s. 633.408; the names, home addresses, telephone numbers, photographs, dates of birth, and places of employment of the spouses and children of such firefighters; and the names and locations of schools and day care facilities attended by the children of such firefighters are exempt from s. 119.07(1) and s. 24(a), Art. I of the State Constitution.”

Editor’s note: Your citation has nothing to do with property records, which are public record. The state requires the financial assets form that you and the other commissioners filled out — and in fact, a new law will require much more information from office-holders starting next year. We will faithfully report that information next year. Our only agenda is transparency in government.

That is incorrect. In the article on the blog the Form 1 that is provided has an address clearly redacted. You have clearly found a way around the redaction but it nevertheless is clearly redacted on the Form 1.

To further clarify, the much more information you refer to next year will still have redacted information on my report. These laws are in place to protect our (first responders) families. It is quite evident by your not only skating the intention of the law, but you’re doubling down on wishing to put my family in harms way that shows the kind of organization you have. Again, I hope all of our first responders and the public who supports them, see that you will go out of your way to hurt them and their families.

Commissioner Ayscue, with all due respect, a simple google search nets the same information.

Whether or not someone wants to dig for information is not the point. The Observer clearly wishes to put my family in danger and violate the spirit of state law. Specifically when the financial disclosure in question has information redacted. The fact remains the Observer made a clear choice to disclose information that is not available through the information they were provided in the financial disclosure. They will stop at nothing to attack first responders, even on First Responders Day.

Be sure to look at the financial disclosures for each of the candidates. In some cases, very little $ from individual contributors. Lots of $ flooded from 3 addresses in Tallahassee that run various PACs. Even more interesting, when you dig into the PACs, are the people and entities contributing large amounts. A little cross reference can offer a lot of insight to the agendas and decisions being made in the City.

Excellent article which sheds much needed light on the income for our City Commissioners. It was hard to find information like this on candidates during the last election, so some of our neighbors got together, divided up the candidates, and researched them before reporting back findings. We did look at property records among other things which are readily available and showed the Commissioners’ properties. It’s misleading to attribute nefarious motives to reporting of fact. It’s puzzling why someone who so values keeping their information very private would run for public office.

This is low, even for the likes of Lendovich. This is a raw personal attack on the City Commissioners, there is no public good gained by publishing all of their home addresses or the financial information above, yes a determined person could find them anyway, that is hardly the point. Of course, our County Democratic Chairperson Coochi jumped to his defense. These people have families. you make me sick Lendovich.

Simply stated factual information.

With my name attached. Not hiding behind a keyboard like some.

What public good is served here?

Given recent discourse on property rights and recent commentary,

one could conclude the objective is not transparency,

but to serve a specific narrative frequently seen on this blog—hmmm.

Let’s not let facts get in the way of a good story. Commissioner Sturges publicly keeps making a big deal about “rich” people on the Commission. But who is actually the rich one on the Commission? If you look at where you can get this information, the information is required to be filed with the state and is public information. If you don’t want to comply with the qualifications for the job, don’t be a Commissioner. New requirements coming up next year should tell a larger story about where our public elected officials receive their income.

Please stop spreading false information. The Form 1 that I filed with the state has redacted information on it. The Form 6 I will file next year will have redacted information on it. My income is already public information and easily found but my address is protected by statute. I am not afraid to provide the information required in the Form 1 or Form 6 as, again, most of it is public record. However, per the statute my address is protected and the Observer continues to attack First Responders and their families by finding ways to publish this information.

The Form 1 referenced is easy to find on the blog version of this article. It has redacted information. Let me say this again; The Form 1 I filed last year has redacted information. I want to mention this lastly; the Form 1 I filed last year has redacted information. There is a reason this statute exists and continues to be supported by the legislature. If you don’t understand why it exists then please feel free to ask but please do not insult First Responders by stating that if they wish to serve their community in another capacity that they should give up their statutory right to have their address protected. That’s very Fernandina Observerish.