The Center Square

The Center Square

August 25, 2020

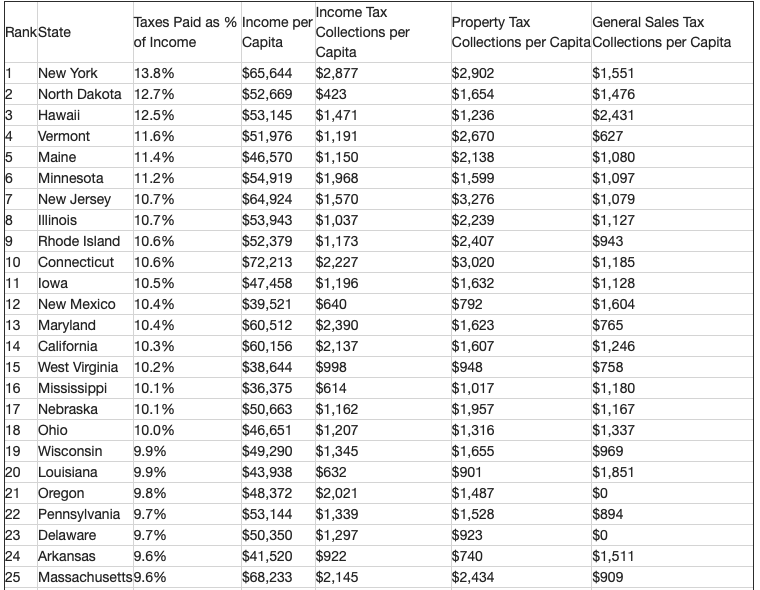

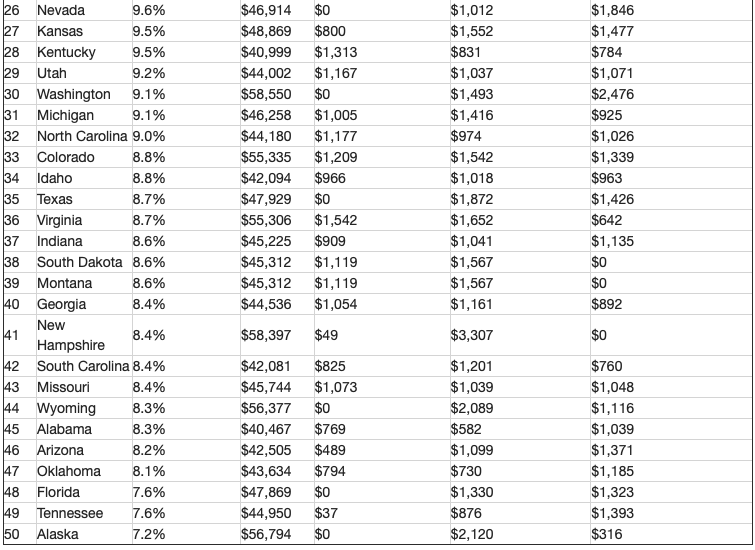

(The Center Square) – Taxpayers in Florida turn over 7.6 percent of their income per capita to state and local governments, the third-lowest percentage among the 50 states, according to an analysis by the website 24/7 Wall St.

State residents pay $0 per capita annually in income tax collections, $1,330 in property taxes and $1,323 in general sales tax collections, 24/7 Wall St. reported.

Nationwide, the portion of Americans’ income turned over to pay state and local taxes averaged 9.8 percent, or just more than $5,000 a year, the analysis found. Federal taxes were not included in the study.

On average, property taxes make up the largest proportion of state and local government revenues nationwide, according to 24/7 Wall St. Those states with higher property tax rates tend to have the highest overall state and local levies, researchers said.

Seven states lack a state income tax, and many in this group had the lowest tax burdens among the 50 states, according to the analysis.

Where Are Americans Paying the Most in State and Local Taxes?

Source: 24/7 Wall St.