From A. Michael Hickox, Nassau County Property Appraiser:

The Notice of Proposed Property Taxes (TRIM Notice) informs the owner of their proposed property values, exemptions, and millage rates for their upcoming tax bill. It states the fair market, assessed, and taxable values. The assessment reductions and exemptions are also listed. The TRIM Notice includes information on proposed millage rates set by the taxing authorities. In addition, it includes times and locations for public hearings being held by these taxing authorities to discuss their tentative budgets, from which their millage rates are set. These meetings are very important, as the millage rates approved by these entities will affect the amount of taxes you pay.

TRIM Notices were mailed out on August 19th. Once received, please promptly examine it to verify that all pertinent information is correct. If you believe information to be in error or if you have any question, we invite you to call and discuss the issue or come in and talk to an appraiser. This process will help us promptly address any concerns you may have. You can contact us at 904-491-7300.

You can access a copy of your TRIM Notice from our website. http://www.nassauflpa.com/

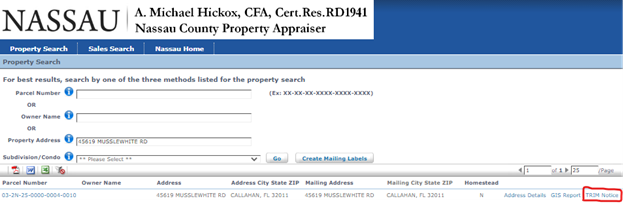

o Use the “Property Search” feature to search for your property then select “GO”

o The populated information will include a link to the TRIM Notice for the selected property.

You can also access a copy of the TRIM Notice on the “Property Details” page by clicking the icon marked in the image above.