Submitted by Suanne Z. Thamm

Reporter – News Analyst

May 5, 2014 7:32 a.m.

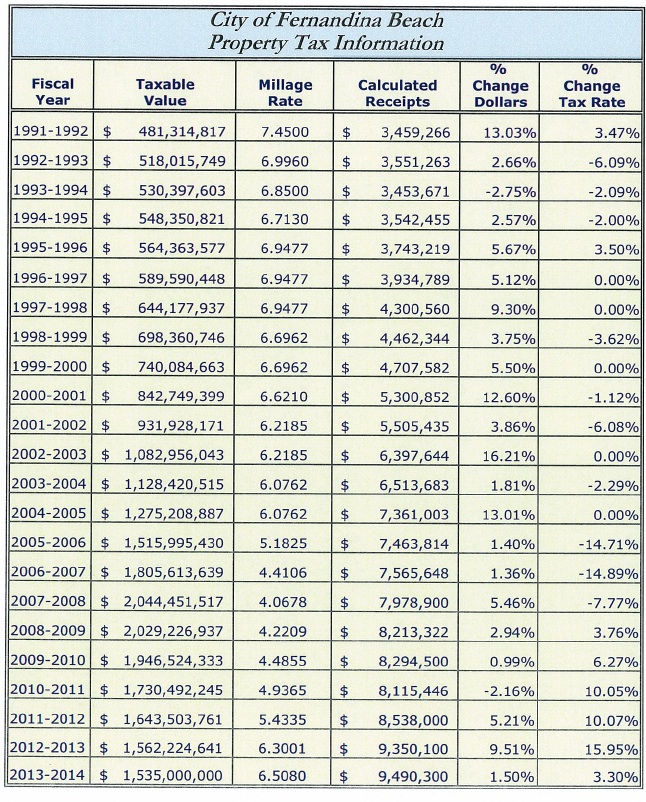

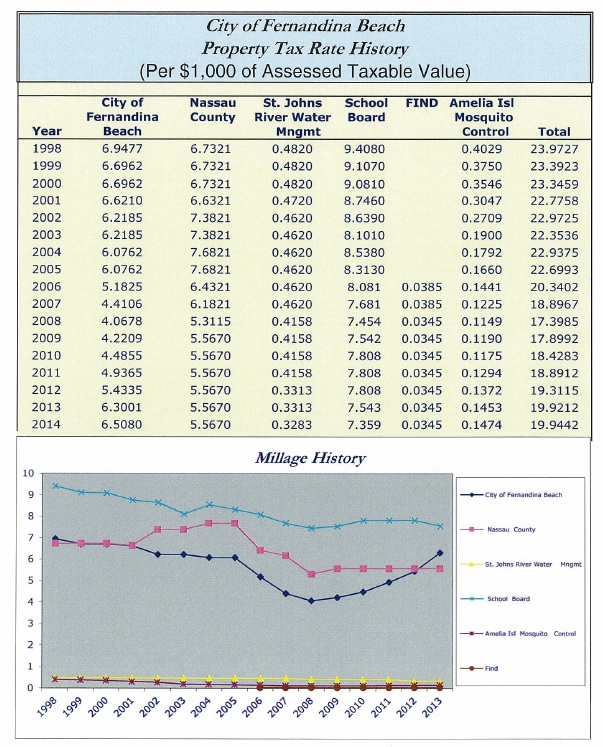

Now that the individual federal tax filing deadline has passed and the state budget has been put to bed, Fernandina Beach residents can turn their attention to the formulation of local government budgets for FY 2014/15. On September 17, 2013, the Fernandina Beach City Commission (FBCC) passed two resolutions adopting a FY 2013/14 city budget of almost $98 million and establishing a property tax rate (millage) of 6.244 as well as voter approved debt millage of .2236. That budget reflected continued cuts in city staffing levels. Over the last two fiscal years a total of 18 city positions have been defunded resulting in a current city workforce of 164 full time and 72 part time employees.

In drawing any conclusions about the upward trends in ad valorem tax rates since FY 2008/09, readers must be mindful of the corresponding decrease in property valuation during that same period. Indeed over recent years the city’s strategy for dealing with the real estate bubble’s burst has been to raise taxes to provide roughly the same levels of service with slightly fewer employees. There have been no sustained initiatives to establish new revenue streams, discontinue programs or services, or shift reliance to the private sector for services currently performed by government.

While it is too early to see what may be in store for city residents in the next fiscal year beginning October 1, 2014, we can look at trends over the past few years.

The charts presented in this article were taken from the published budget of the City of Fernandina Beach. All 288 pages of the budget are available for downloading or viewing in the Documents Center on the city’s website: fbfl.us.

City Funds

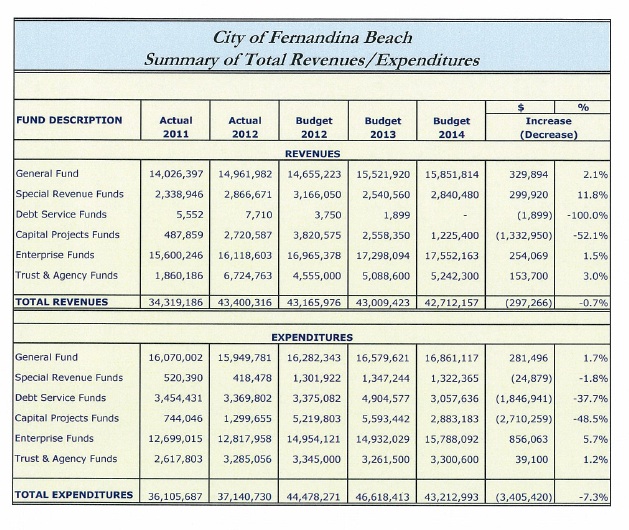

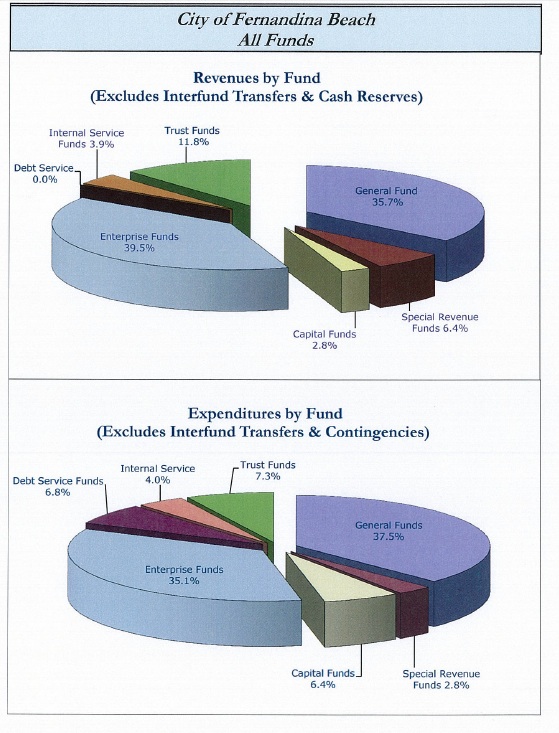

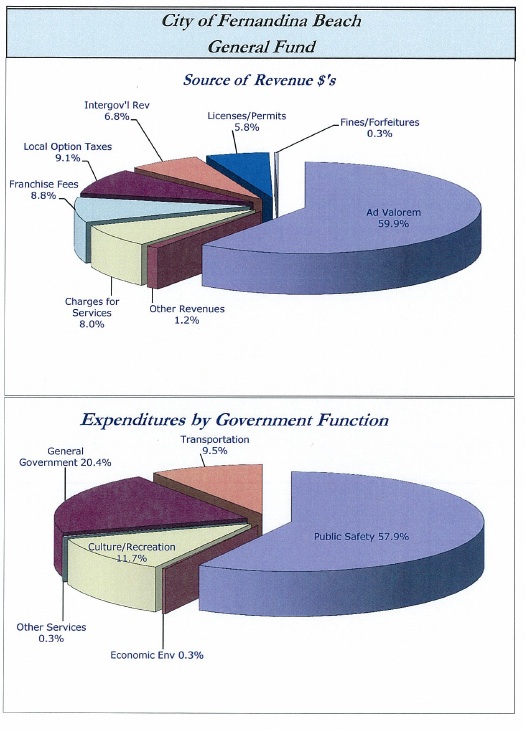

Citizens need to be mindful that while the overall budget of the city is close to $98 million, not all of that money comes from taxes, nor may it be used for every type of public purpose. That figure represents the combined total of various funds, many of which can only be expended within that fund or for specific purposes as determined by law.

The primary pot of money over which the FBCC has discretion is the General Fund. That fund, which supports public safety, recreation, streets and general administration is the largest city fund and accounts for only 35.7% of the total budget.

There are seven Enterprise Funds that operate from user charges for services provided the enterprise. These funds are intended to be self-supporting and may include payments to the General Fund for administrative services. Those funds include: Golf Course, Airport, Sanitation, Wastewater Operations, Water Operations, Storm Water Management and Marina. The Internal Service Funds cover the Central Garage, Utility Billing and Utility Administration.

There are seven Enterprise Funds that operate from user charges for services provided the enterprise. These funds are intended to be self-supporting and may include payments to the General Fund for administrative services. Those funds include: Golf Course, Airport, Sanitation, Wastewater Operations, Water Operations, Storm Water Management and Marina. The Internal Service Funds cover the Central Garage, Utility Billing and Utility Administration.

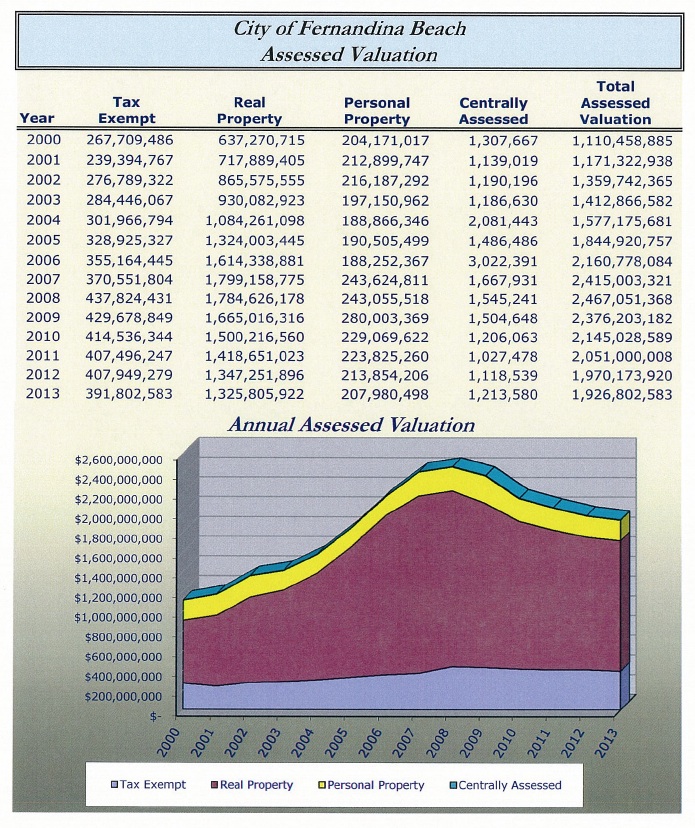

The Nassau County Property Appraiser, a public official elected by the entire county, is responsible for placing a value on all property within Nassau County, including that in the City of Fernandina Beach. The value of all taxable property within the city is the baseline for levying the ad valorem tax millage. Between FY 2008 and the current fiscal year, that figure dropped from $2.467 billion to $1.927 billion, seriously impacting the finances of all local governments. As the charts below indicate, the city chose to address the shortfall by raising its millage rates. Since the Property Appraiser’s Office will not update the valuation numbers until early summer, it is not possible to determine at this time whether the valuation continues to drop, or whether it has bottomed out or even increased over the past year.

Comparisons

While the real estate bubble and the economic downturn of the last few years have affected all local government entities, the charts below provide a comparison of trends and rates among the various local taxing authorities.

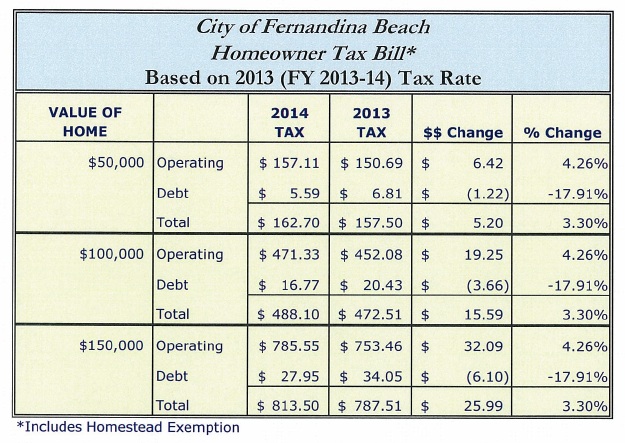

What does it mean for the average homeowner?

The chart below reflects what the adopted millage rate for the city translates to in dollars and cents for property owners.

Preparing for the next budget year

As summer approaches, work on the next city budget will accelerate. Within the city, the various departments will be working with the City Manager to determine staffing and budget needs to meet priorities endorsed by the FBCC. There will be several public workshops to de-mystify the budget process and allow citizens to understand how their tax dollars will be spent. Interested citizens may keep abreast of those workshops by checking the calendar of events on the city’s website, fbfl.us. The Nassau County Board of County Commissioners and the Nassau County School Board will also be holding public meetings on their budgeting for the next fiscal year.

The Fernandina Observer will continue to update readers on important budget developments as they happen.